Table of Contents

As the CEO of Qualify Health, I’ve seen how healthcare organizations struggle with financial sustainability while trying to serve their communities effectively. The 340B Program, or 340B Drug Pricing Program, is one of the most impactful for eligible healthcare providers. It can extend resources and enhance patient care. But it is often misunderstood. And understanding who qualifies for the 340B program isn’t just beneficial, it’s essential for a hospital’s survival and growth.

This blog post will provide you with the critical information you need to navigate the complexities of 340B qualification. Whether you’re exploring 340B eligibility for the first time or looking to optimize your existing program, you can leverage its full potential for your organization and patients.

Understanding the 340B Drug Pricing Program Fundamentals

The 340B drug pricing program was created in 1992 to serve a specific mission: enable covered entities to “stretch scarce federal resources as far as possible, reaching more eligible patients and providing more comprehensive services.

The 340B program achieves its mission by requiring pharmaceutical manufacturers participating in Medicaid to sell outpatient drugs to eligible healthcare organizations at significantly discounted drug prices, often 25-50% below retail.

The program has become a vital financial lifeline for America’s safety net providers, organizations committed to serving patients regardless of their ability to pay. The 340B program, when implemented effectively, allows these organizations to:

- Expand services to vulnerable patient populations

- Offset costs of uncompensated care

- Fund critical community health initiatives

- Maintain financial viability despite slim margins

The savings generated through 340B aren’t simply “nice to have”. They can be essential for survival for organizations serving disadvantaged communities. And the rising pharmaceutical costs and the resulting strain on healthcare budgets make understanding your eligibility for this program more important than ever before.

Covered Entity Eligibility - Who Qualifies?

1. Hospital Eligibility

To qualify as a hospital, you must generally:

- Be owned or operated by a state/local government OR be a nonprofit hospital with a contract to provide care to low-income patients

- Have specific hospital designations such as:

- Disproportionate share hospitals with a DSH adjustment percentage exceeding 11.75%

- Critical access hospitals serving rural communities

- Sole community hospitals that are the primary hospital in an area with a DSH adjustment percentage above 8%

- Rural referral centers with a DSH adjustment percentage greater than 8%

- Children’s hospitals and free-standing cancer hospitals meeting certain criteria

2. Federal Grantee Eligibility

- Federally qualified health centers and Look-Alikes

- Ryan White HIV/AIDS Program grantees

- Family planning clinics

- Tuberculosis clinics

- Black Lung clinics

- Native Hawaiian Health Centers

- Urban Indian Organizations

Registration for the program occurs quarterly through the Office of Pharmacy Affairs Information System (340B OPAIS), with specific deadlines for each enrollment period. The Health Resources and Services Administration (HRSA) oversees the program and verification process.

Patient Eligibility Criteria

Perhaps the most nuanced aspect of the 340B program is determining which patients qualify to receive medications purchased at 340B prices. Being a 340B eligible patient is not determined by insurance status or income level, but rather by the individual’s relationship with the covered entity.

For a patient to qualify, three primary criteria must generally be met:

- The covered entity must maintain health records for the individual

- The healthcare provider must either be employed by the covered entity or have a contractual relationship where the entity maintains responsibility for care

- The patient must receive healthcare services from the covered entity beyond just dispensing of medication

Common misconceptions about 340B patient eligibility requirements include assuming all uninsured patients automatically qualify or that all prescriptions written by employed providers are eligible. In reality, the focus is on establishing a genuine patient-provider relationship. This means:

- The entity maintains electronic or paper health records documenting the patient’s care

- The patient receives more than just prescription services from the covered entity

- There’s ongoing clinical care and responsibility, not just a one-time encounter

- The services provided align with the scope of grant funding or hospital services

Maximizing Compliance While Expanding Access

Maintaining 340B eligibility requires a robust compliance program focused on preventing diversion (providing 340B drugs to ineligible patients) and duplicate discounts (when a drug receives both a 340B discount and a Medicaid rebate).

Successful compliance strategies include:

- Implementing clear policies and procedures specific to your organization type

- Conducting regular internal audits to identify potential issues before HRSA does

- Properly identifying and flagging 340B-eligible prescriptions

- Ensuring your team understands the nuances of 340B patient eligibility criteria

- Maintaining comprehensive documentation of patient relationships

Technology solutions can streamline compliance efforts through automated eligibility checking, inventory segregation, and reporting capabilities. Prioritize technology that can adapt to the evolving regulatory landscape when vetting solutions.

Balancing compliance with access to affordable medication also requires thoughtful program design. Consider implementing patient assistance programs that utilize 340B savings to provide medications at reduced or no cost to uninsured or underinsured patients. This approach both fulfills the spirit of the program and creates measurable community benefits that can be documented and shared with stakeholders.

Remember that compliance isn’t just about avoiding penalties, it’s about building a sustainable program that can withstand scrutiny while maximizing your ability to serve patients in need.

Strategic Implementation for Healthcare Leaders

As a healthcare leader, your approach to the 340B program should be strategic rather than merely tactical. Assess how the program integrates with your organization’s overall financial and clinical goals beyond basic eligibility and compliance.

Key implementation considerations include:

- Align 340B strategy with your organization’s mission and community needs

- Determine the optimal pharmacy model (in-house, contract, or hybrid)

- Establish clear metrics to measure program impact

- Create transparent processes for allocating 340B savings

- Engage clinical leadership in program decisions

I’ve seen organizations transform their financial outlook by strategically reinvesting 340B savings into expanded clinical services, enhanced care coordination programs, or technology infrastructure that improves efficiency. The most successful implementations share a common feature: they’re viewed as strategic assets rather than just compliance obligations.

Communication is equally critical. Ensure your board, leadership team, and staff understand both the requirements and the value of your 340B program. And you can build internal support and engagement with regular updates on program metrics and patient impact stories.

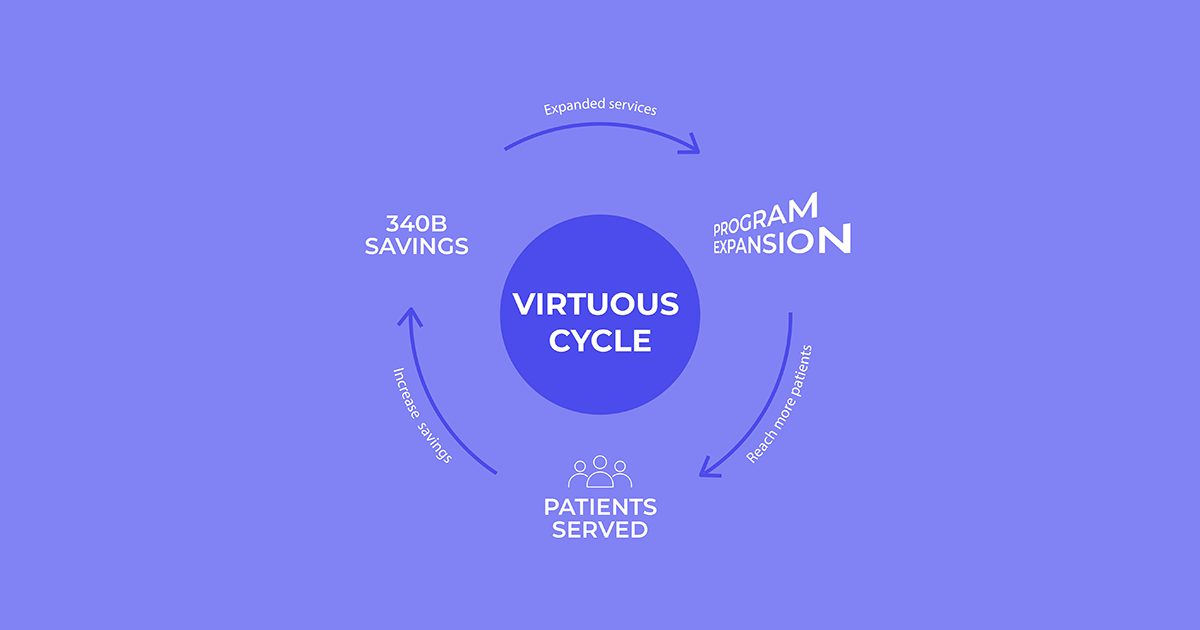

When done correctly, the 340B program creates a virtuous cycle:

savings generated from the program fund expanded services, →

which in turn serve more eligible patients, →

potentially increasing 340B savings further.

Moving Forward with Confidence

Understanding who qualifies for the 340B program is just the beginning of a potentially transformative journey for your healthcare organization. The requirements may be complex, but the potential impact, both financial and clinical, makes navigating these complexities worthwhile.

As you evaluate your own organization’s eligibility or work to optimize your existing program, remember that the ultimate measure of success isn’t just compliance or savings generated, it’s the expanded access to care and improved health outcomes for the communities you serve.

My team at Qualify Health is passionate about helping healthcare organizations optimize their financial operations to better serve patients. I hope this post serves as a valuable resource in your 340B journey. If you’re looking to further enhance your organization’s financial health while improving patient care access, explore our automated financial assistance matching platform. With no upfront fees, retroactive matching capabilities, and zero IT burden, our solution helps healthcare providers reduce bad debt while connecting patients with billions in available funding.